Taxes

The Pitfalls of Corporate Ownership of Real Estate

Owning real estate through a corporation, be it a C corporation or an S corporation, might seem like a prudent business strategy at first glance. However, this method of holding property can introduce a range [...]

Are There Special Tax Rules for a Gift or Inheritance from a Foreign National?

If you have close relatives who are citizens of another country, you might receive a gift or inheritance from them at some point. While you usually do not have to pay taxes to the IRS [...]

What Is the Generation-Skipping Transfer Tax?

The estate tax gets all the press, but if you are leaving property to a grandchild, there is an additional tax you should know about. The generation-skipping transfer (GST) tax is a tax on property [...]

IRS Announces That Face Masks and Related Purchases Are Tax Deductible

The IRS has announced that the tax deduction for medical expenses includes amounts spent on face masks, sanitizer and other products purchased to prevent the spread of the coronavirus. If you have significant medical expenses, [...]

Will You Owe a Gift Tax This Year?

The rules surrounding taxes on gifts often create confusion during tax season or any other time. Below are some of the nuts and bolts of the gift tax, including when a gift tax form needs [...]

Long-Reviled Military ‘Widow’s Tax’ Is Finally Being Phased Out

A controversial policy that reduces the benefits of military spouses is on the way out. The so-called “widow’s tax” cuts assistance to surviving military spouses who qualify for benefits under two different military benefit programs. [...]

What is “Stepped Up Basis” and How Does it Affect Estate Planning?

Phrases like “stepped up basis” tend to make the average person’s eyes glaze over. Everyone wants to maximize wealth and minimize expenses such as tax obligations. And, they want to avoid unnecessary tax burdens for [...]

Estate Planning Under Trump’s New Tax Law

From an estate planning perspective, the highest-profile aspect of the new tax law is that the federal estate tax exemption has been doubled. The jump from $5.5 million to just over $11 million ($22 million [...]

Will Your Cryptocurrency Die with You?

Cryptocurrency hasn’t exactly gone mainstream, but it’s no longer a rare, fringe holding. A recent survey revealed that nearly 8% of Americans own at least some Bitcoin or other form of cryptocurrency, and another 7.76% [...]

Benefits of a Charitable Remainder Trust

Even if you haven’t yet invested in estate planning, you’ve probably heard of Charitable Remainder Trusts (CRTs). When you visit your favorite non-profit’s website or receive a solicitation letter from your alma mater, you may [...]

Federal Estate Tax Exemption Increases, but Tax Planning is Still a Must

New Jersey residents got relief from state estate taxes earlier this year. After a multi-year step-down process, state estate taxes were wholly eliminated for those who died on or after January 1, 2018. Now, the [...]

Understanding the New Jersey Retirement Income Tax Exclusion

New Jersey has long provided state income tax exclusions for pensions and other retirement income. The state doesn’t tax Social Security benefits at all, and even provides a special exclusion for taxpayers aged 62 and [...]

No New Jersey Estate Tax after December 31, 2017

In 2016, the New Jersey legislature repealed the state’s estate tax, but phased in the change. For those who passed away during calendar year 2017, there was a significant bump in the exemption. Prior to [...]

Avoid These 8 Common Estate Planning Mistakes

The most common and most significant estate planning error is failing to plan at all. About half of U.S. adults don’t even have a will, arguably the most basic estate planning document. Unfortunately, many of [...]

How A Living Trust Helps Your Family

There are several parts to an estate plan, one of them being a living trust. Common factors that prompt someone to create a trust include privacy, tax benefits, avoiding probate, and caring for family members [...]

Be Aware of the Kiddie Tax Before Leaving an IRA to Children

Grandparents may be tempted to leave an IRA to a grandchild because children have a low tax rate, but the "kiddie tax" could make doing this less beneficial.An IRA can be a great gift for a grandchild. [...]

Owe Back Taxes? The IRS May Grant You Uncollectible Status

Sometimes seniors find themselves owing past-due federal taxes they cannot afford to pay. Although notices from the IRS can be especially frightening, there are solutions.If the sum owed is less than $50,000, the IRS will [...]

The sun has risen again. How you and your family can benefit from a (legal) late portability election.

The concept of “portability” is still relatively new in the law of estate planning, having become available only after 2011. Since then, it’s been both a blessing (for its tax saving benefit) and a curse [...]

Adding to Uncertainty for Scam Targets, the IRS Now Allows Private Debt Collectors to Dun Taxpayers

In a move that could be confusing to seniors who are vulnerable to scams, the IRS will begin using private debt collection agencies to collect past-due taxes. The new program will begin in April 2017.Authorized [...]

How a Community Property Trust Could Save You From Heavy Taxation Down the Road

When it comes to your family’s legacy, every dollar you can save from tax collection counts. One way to keep your assets out of the hands of the IRS is the formation of community property [...]

Not Just Death and Taxes: 5 Essential Legal Documents You Need for Incapacity Planning

Comprehensive estate planning is more than your legacy after death, avoiding probate, and saving on taxes. Good estate planning includes a plan in place to manage your affairs if you become incapacitated during your life [...]

Things to Remember at Tax Time

Tax day, which is April 18th in 2017, is approaching and it is time to begin crossing T's and dotting I's in preparation for paying taxes. As tax time draws near, you want to make [...]

New Legislation Could Mean the End of Estate and GSTT Taxes

On January 24, 2017, the Death Tax Repeal Act of 2017, or H.R. 631, was introduced to the U.S. House of Representatives by South Dakota congresswoman Kristi Noem. If passed, H.R. 631 would completely repeal [...]

How to Pass Your Home to Your Children Tax-Free

Giving your house to your children can have tax consequences, but there are ways to accomplish it tax-free. The best method to use will depend on your individual circumstances and needs. Leave the house in [...]

IRS Issues Long-Term Care Premium Deductibility Limits for 2017

The Internal Revenue Service (IRS) is increasing the amount taxpayers can deduct from their 2017 income as a result of buying long-term care insurance. Premiums for "qualified" long-term care insurance policies (see explanation below) are [...]

An Overview of the IRC Section 2704 Proposal

Section 2704 of the Internal Revenue Code (IRC) pertains to family-controlled corporations and partnerships, specifically dealing with gratuitous transfers between family members in connection with the family owned business. According to IRC, the IRS can [...]

Understanding the Irrevocable Life Insurance Trust

Life insurance can give great peace of mind to the insured by providing for their loved ones after their death. Life insurance benefits can help pay for your children’s college education or provide for your [...]

Does My Trust Need a Separate Tax ID Number?

The type of trust that you utilize in your estate planning will affect how the trust’s income will be taxed. This is an important consideration when creating a trust as it will determine who will [...]

Estate Planning for Cross-Border Families

Estate planning is always a highly involved process but for cross-border families, estate planning can be rife with difficulties. Those who own assets in foreign countries or are married to a non-citizen spouse have additional [...]

Act Now! There’s Still Time to Avoid the New IRS Regulations That Might Raise Taxes on Your Family’s Inheritance

The IRS recently released proposed regulations which effectively end valuation discounts that have been relied upon for over 20 years. If the IRS’s current timetable holds, these regulations may become final as early as January [...]

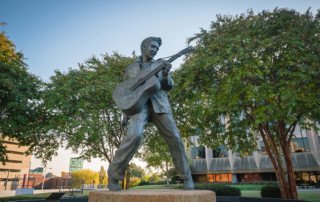

Over 70% of Elvis Presley’s Estate Paid in Taxes & Fees: How Can You Avoid the Same Trap?

Did you know that the legendary singer and actor, Elvis Presley, earned over a billion dollars throughout his somewhat short career? That’s billion – with a B. However, when the “King of Rock & Roll” [...]

What the Recently Released 2016 IRS Inflation Adjustments Mean for You

The Internal Revenue Service has released the official inflation adjustments that will affect 2016 federal reporting for estate taxes, gift taxes, generation-skipping transfer taxes, and estate and trust income taxes. These changes will affect the [...]

Listen Up: These States Will Usher in Changes to Their Death Taxes in 2016

In 2015, there are still 20 U.S. jurisdictions that collect a death tax at the state level: Connecticut, Delaware, District of Columbia, Hawaii, Illinois, Iowa, Kentucky, Maine, Maryland, Massachusetts, Minnesota, Nebraska, New Jersey, New York, [...]

Have You Prepared Your 2015 Year End Gift Plan?

With the end of the year fast approaching, now is the time to fine tune your gift planning before you get caught up in the chaos of the holiday season. Aside from making annual exclusion [...]

Is There an Income Tax Time Bomb Lurking in Your Estate Plan?

As the federal estate tax exemption has ballooned from $1.5 million ten years ago to $5.43 million today, the need for estate tax planning has drastically decreased. Instead, higher income tax rates that were ushered [...]

Early Predictions About 2016 Estate Tax, Gift Tax, GST Tax and Annual Gift Tax Limits

Under current law the federal estate tax, gift tax, and generation-skipping transfer tax exemptions have become unified and are indexed for inflation on an annual basis. Since 2011, the exemption and tax rate have changed [...]

Don’t Miss Out on These Year-End Tax Planning Strategies

Now is the ideal time to start year-end tax planning. Below you will find a variety of tax-saving strategies you should consider using immediately so that you can get your 2015 tax house in order [...]

What You Need to Know About the Final Estate Tax Portability Rules

Recently the IRS issued the final rules governing the “portability election” as it relates to the federal estate tax exemption. Married couples need to understand how these final rules may affect their existing estate plans, [...]

IRS Announcement: Estate Tax Closing Letters Will Now Only Be Issued Upon Request

Due to the increased volume of federal estate tax return filings in order to make the “portability election,” the IRS has announced that estate tax closing letters will only be issued upon request by the [...]

Federal and State Death Tax Updates

Death taxes are back in the news at the federal level as well as in Delaware and Minnesota. What Happened to the Death Tax Repeal Act of 2015? Back in February and March of 2015, [...]

Death Tax Repeal Act Introduced in House and Senate

Identical bills have been introduced in the U.S. House and Senate that would permanently repeal the federal estate tax and generation-skipping transfer (“GST”) tax. Overview of Current Federal Estate, Gift, and GST Tax Laws Under [...]

When is an Estate Subject to State Death Taxes?

In the United States, certain states collect a death tax based on the value of the deceased person’s estate and who inherits it. Which States Collect a State Death Tax? As of January 1, 2015, [...]

Five Things You Need to Know About the Recently Enacted ABLE Act

On December 19, 2014, President Obama signed the Achieving a Better Life Experience Act (ABLE Act) into law. The ABLE Act will allow certain individuals with disabilities to establish tax-free savings accounts that can be [...]

Year End Estate Planning Tip #5 – Make Gifts that Your Family Will Love but the IRS Won’t Tax

Don’t let the chaos of the holiday season prevent you from avoiding federal gift tax by making “annual exclusion” gifts, medical payments gifts, and educational gifts. Make Annual Exclusion Gifts “Annual exclusion” gifts are transfers [...]

What the 2015 Inflation Adjustments for the Estate Tax Exemption and Trust Income Tax Brackets Mean for You

The Internal Revenue Service has released the official inflation adjustments that will affect 2015 federal reporting for estate taxes, gift taxes, generation-skipping transfer taxes, and estate and trust income taxes. 2015 Federal Estate Tax Exemption [...]

2015 Changes to State Death Taxes

If you live or own property in one of the 20 jurisdictions listed below, then you may have a state death tax issue that requires planning. Currently 20 U.S. jurisdictions collect a death tax at [...]

Year End Estate Planning Tip #1 – Check Your Estate Tax Planning

With the end of the year fast approaching, now is the time to fine tune your estate plan before you get caught up in the chaos of the holiday season. One area that married couples [...]

Strategies for Reducing the Income Tax Squeeze on Irrevocable Trusts

Under federal income tax laws, irrevocable, non-grantor trusts (such as Bypass Trusts and Dynasty Trusts) are subject to highly compressed income tax brackets. In 2014, the top 39.6% tax rate kicks in at only $12,500 [...]

Does Your Revocable Living Trust Reduce Your Estate Tax Bill?

Many people believe that once they set up and fund a revocable living trust, property held in the trust will avoid estate taxes after they die. In reality, this may or may not be true [...]

How to Minimize the (Voluntary) Federal Estate Tax with Portability

Surprising to most people, the federal estate tax is a voluntary tax. Estate planning attorneys used to say, “You only pay if you don’t plan.” Now, portability provides both an alternative and a back up [...]