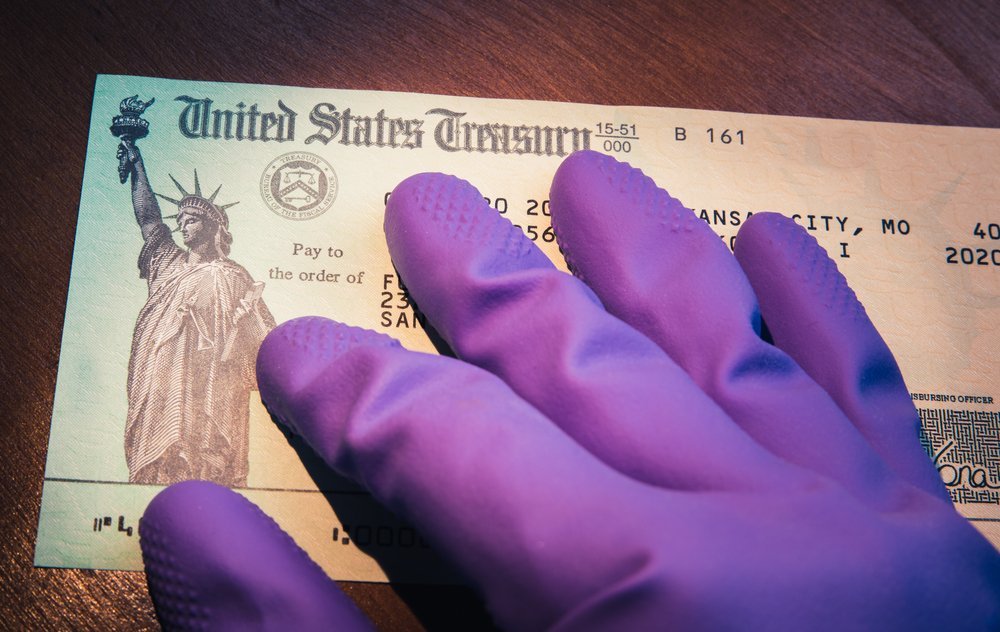

What To Do With Your Stimulus Check if You Are in a Nursing Home

As the second round of stimulus checks go out, it is important to know that nursing home residents are not required to turn their checks over to their nursing home. And Medicaid recipients need to spend the cash within a year if it puts them over Medicaid’s resource limit.

Posted on January 29, 2021

In December 2020, Congress approved $600 stimulus checks for individuals making less than $75,000 a year. Those checks should be sent to everyone eligible, including individuals on Medicaid and in a nursing home or assisted living facility.

The Federal Trade Commission (FTC) is reminding nursing home and assisted living residents that their stimulus checks are for them, not their facility. With the first round of stimulus checks, there were reports that facilities were taking the checks without residents’ permission. The FTC says that if nursing homes ask for a resident’s check, the resident should contact the state attorney general and the FTC.

Medicaid recipients who receive a stimulus check that puts them above Medicaid’s resource limit will need to spend down the money within a year or risk losing benefits. The Social Security Administration has said that it will not consider stimulus payments as income, and that the payments will be excluded from a Medicaid recipient’s resources for 12 months. The following are examples of what a Medicaid recipient may be able to spend the money on without affecting their eligibility:

- Make a payment toward paying off debt.

- Make small repairs around the house.

- Update personal effects. Buy household goods or personal comfort objects. Buy a new wardrobe, electronics, or furniture.

- Buy needed medical equipment, see a dentist or get eyes checked if those items aren't covered by insurance.

If you have questions about how you or a family member in a nursing home can spend the money, contact your elder law attorney.

More from our blog…

Elder Financial Abuse: How an Elder Law Attorney Can Help

Elder financial abuse is a significant issue affecting many older adults nationwide. It involves someone exploiting or misusing an older person’s finances or assets for [...]

Does Medicare Cover Prescription Weight Loss Drugs?

Americans have a growing appetite for prescription drugs such as Ozempic, Wegovy, and Mounjaro. Originally developed to treat Type 2 diabetes, they are now exploding [...]

How Social Security Overpayment Rules Are Changing

With a new commissioner at the helm, the Social Security Administration (SSA) has been announcing several policy changes in recent weeks. In late March 2024, the [...]

Claiming the Guardianship of an Elderly Parent

Often an aging parent will lose their ability to think clearly or make informed decisions about their life. This may occur because of dementia, mental [...]

Recent blog posts

FREE WEBINAR

5 Things to Know About

Estate Planning

When You Turn Sixty-Five